When you shop in the UK, you pay a sales tax (VAT) on most goods. The current VAT rate in the UK is 20% which equates to 16.67% of the sales price.TAX FREE SHOPPING & EXPORT

If you are resident outside of the UK, you are entitled to shop tax-free for goods purchased in-store. ROX has to export the goods directly to your overseas residential address.

For example:

If you spend £2,000, you can save £333 so you only pay £1,666

If you spend £5,000, you can save £833 so you only pay £4,166

If you spend £7,500, you save £1250 so you only pay £6,250

If you spend £10,000, you save £1666 so you only pay £8,333

The Tax-free Shopping Export Service is provided free of charge by ROX for all goods purchased in-store. Please note that you are responsible for paying import duties and / or other taxes when importing the goods into your country of residence.

When you shop in the UK, you pay a sales tax (VAT) on most goods. If you are resident outside the EU, you are entitled to reclaim the VAT on most items purchased and taken home.TAX FREE

In the UK the current VAT rate is 20% which equates to 16.67% of the sales price.

We charge an administration fee to the traveller for organising the Tax Refund which is 2.67% of the selling price and capped at £250. A handling fee may apply to cash refunds. Refunds are given subject to meeting HMR&C regulations and Tax Free terms and conditions.

Rule 1 - You must be resident outside of the EU to qualify for a Tax Free Refund.Three Golden Rules

Rule 2 - You must complete the Tax Free form at the point of sale and get your sales consultant to sign it.

Rule 3 - You must leave the EU within 3 months after the month of purchase.

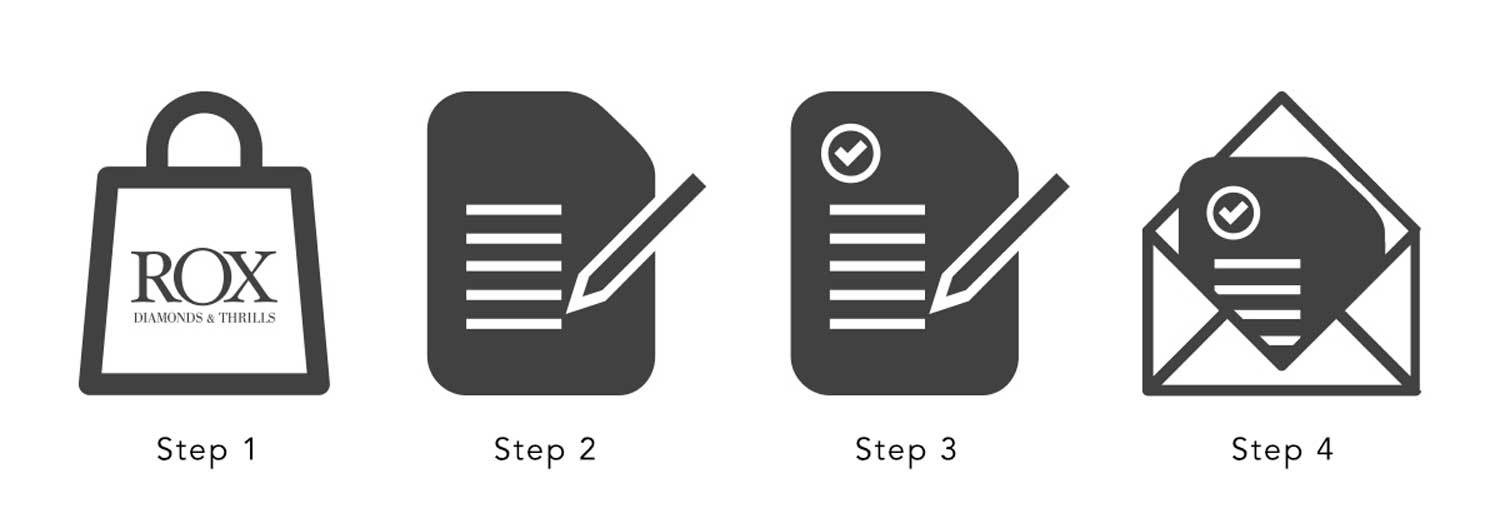

1. Shop in the store and ask for your Tax Free form.How to Claim Your Refund

2. Complete your personal details and we'll sign your Tax Free form.

3. At your final point of exit from the UK, get your Tax Free form stamped by Customs. Claim your cash refund at the airport or post your stamped form in the Customs box for a credit card refund.

4. If there is no Customs desk simply post your Tax Free form in the Airport VAT Reclaim box for a credit card refund.